The Portfolio Cannibalization Trap , In the world of personal finance, we are taught one golden rule above all others: Diversification. “Don’t put all your eggs in one basket,” they say. And they are right.

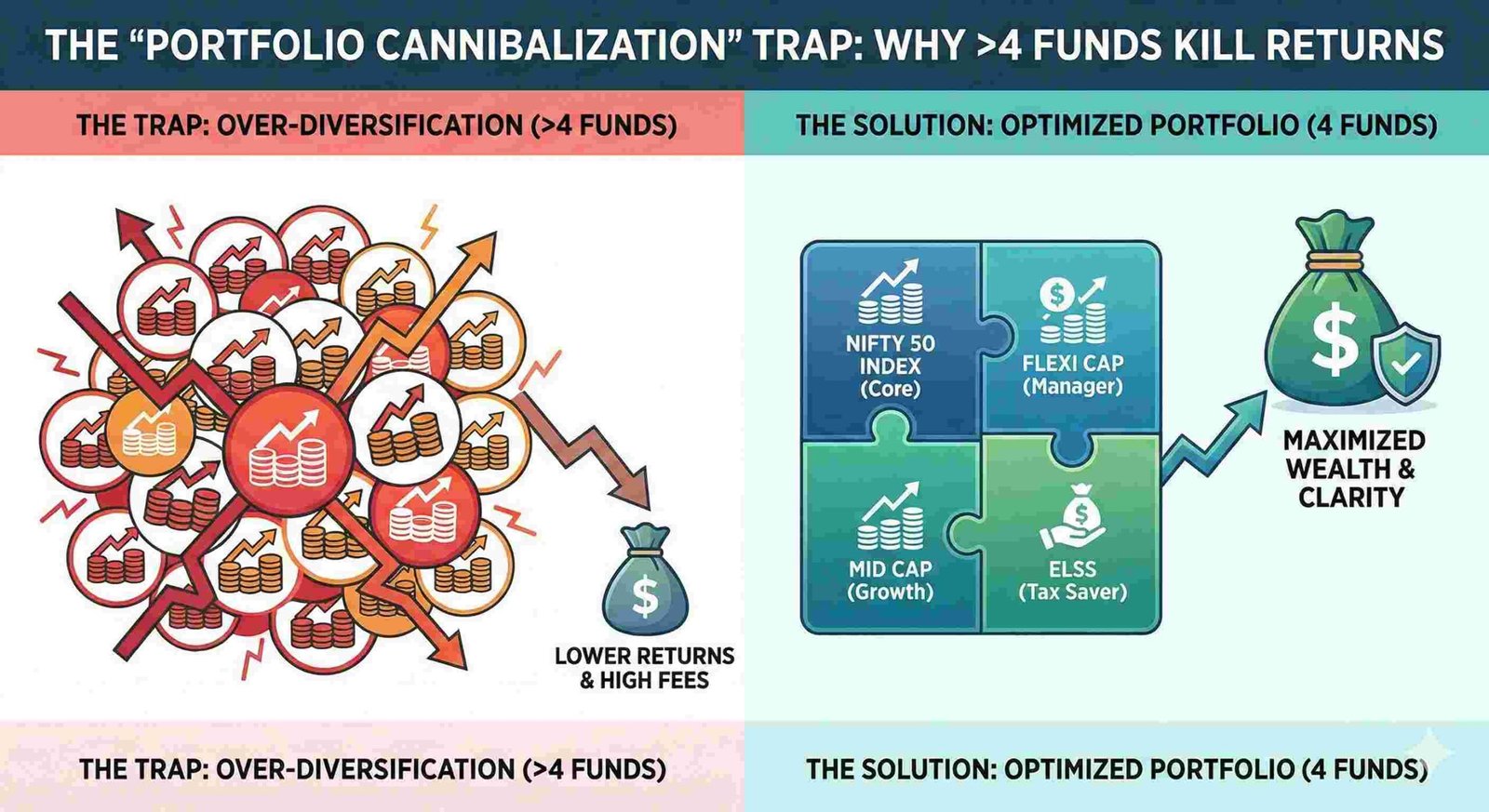

However, there is a dangerous tipping point where diversification turns into a portfolio killer. It is a phenomenon I call “Portfolio Cannibalization.”

Most retail investors believe that if owning 2 mutual funds is good, owning 10 must be better. This logic is flawed. If you look at your portfolio and see 8, 10, or 12 different mutual fund schemes, you aren’t diversifying—you are likely “di-worsifying.” You are paying multiple fund managers high fees to buy the exact same stocks, effectively canceling out your potential for high returns.

In this guide, we will break down the mathematics of over-diversification, expose the hidden costs of holding too many funds, and provide the ultimate 4-Fund Strategy to skyrocket your wealth.

What is Portfolio Cannibalization?

Portfolio Cannibalization occurs when you own so many different mutual funds that their underlying holdings overlap significantly. Instead of your funds working together to build wealth, they start “eating” each other’s performance.

When one fund manager makes a brilliant decision to buy a stock (e.g., HDFC Bank), another manager in your portfolio might be selling it or holding a completely different view. The result? Your net movement is zero, but you still pay the management fees for both actions.

You are no longer an investor; you have accidentally created a commercially expensive “Index Fund” with none of the benefits.

The Warning Signs

You might be a victim of portfolio cannibalization if:

- You own more than 2 funds in the same category (e.g., 3 different Large Cap funds).

- You cannot name the top 5 holdings of your portfolio off the top of your head.

- Your portfolio returns rarely beat the Nifty 50 or Sensex, even in bull markets.

The Math of Mediocrity: Why More is Less

Let’s look at the data. Many investors hoard funds like collectibles. But statistically, after the 4th or 5th fund, the marginal benefit of diversification drops to near zero, while the complexity and cost skyrocket.

Below is a chart demonstrating how increasing the number of funds dilutes your potential for “Alpha” (beating the market).

Chart 1: The Law of Diminishing Returns

| Number of Funds | Diversification Benefit | Probability of Beating Market | Portfolio Complexity |

| 1-2 Funds | High Risk (Concentrated) | High (Volatile) | Very Low |

| 3-4 Funds | Optimal (Sweet Spot) | Maximized | Low (Easy to manage) |

| 5-8 Funds | Marginal Benefit | Low (Diluted) | Medium |

| 9+ Funds | Negative (Cannibalization) | Near Zero | High (Chaos) |

Analysis: As you can see, once you cross 4 funds, you stop reducing risk and start reducing returns. You essentially own the entire market, but you are paying active management fees (1.5% to 2%) for it, whereas a simple Index Fund would have done the same for 0.1%.

The “Overlap Trap”: Visualizing the Problem

Focus Keyword: Mutual fund overlap

The biggest cause of cannibalization is Overlap. Let’s say you own a “Bluechip Fund” from AMC ‘A’ and a “Focused Fund” from AMC ‘B’. You think you are diversified because the names are different.

However, if you look inside the portfolio, the reality is shocking.

Chart 2: The Overlap Matrix (Example)

| Stock Name | Bluechip Fund A (Holding %) | Focused Fund B (Holding %) | Large Cap Fund C (Holding %) | Total Exposure |

| Reliance Ind. | 9.5% | 8.2% | 9.0% | 26.7% (Dangerous) |

| ICICI Bank | 8.0% | 7.5% | 8.5% | 24.0% (Dangerous) |

| Infosys | 6.0% | 5.5% | 6.0% | 17.5% |

| Unique Stocks | 15% | 10% | 12% | Minimal |

The Result: You think you own three distinct products. In reality, nearly 70% of your money is chasing the same top 10 stocks. If the banking sector crashes, all three of your funds crash. You have zero protection.

Important Link: [Check Your Portfolio Overlap Here – Morningstar/ValueResearch Tool] (Insert outbound link to a reputable tool like Value Research or Morningstar)

The Hidden Cost: Expense Ratios Bleeding Your Wealt

When you hold 10 funds, you often ignore the Expense Ratio (TER) because it looks small (e.g., 1.8%). But over 15-20 years, fees compound just like interest does.

If you consolidate your money into 4 high-quality funds (or Direct Plans), you can significantly lower your weighted average expense ratio.

Chart 3: The Cost of Clutter (20 Year Projection)

Assumption: Initial Investment ₹10 Lakhs, 12% Annual Return.

| Portfolio Type | Avg Expense Ratio | Portfolio Value after 20 Years | Fees Paid to AMC |

| Cluttered (12 Funds) | 2.2% (Regular Plans) | ₹65.4 Lakhs | ₹18.2 Lakhs |

| Optimized (4 Funds) | 0.8% (Direct Plans) | ₹85.9 Lakhs | ₹6.5 Lakhs |

| Difference | + ₹20.5 Lakhs | Saved ₹11.7 Lakhs |

Takeaway: By simply cleaning up your portfolio and moving to a streamlined 4-fund strategy, you could arguably buy a brand new car with the money you saved on fees alone.

The Solution: The “Core & Satellite” 4-Fund Strategy

So, if 12 funds are too many, what is the magic number? For 99% of retail investors, the answer is Four.

You need to structure your portfolio to cover the entire market capitalization (Large, Mid, Small) without overlapping. This is known as the Core & Satellite approach.

Chart 4: The Perfect 4-Fund Allocation

| Fund Type | Allocation % | Role in Portfolio | Risk Level |

| 1. Nifty 50 Index Fund | 40% | The Anchor (Core). Provides stability and mirrors market growth. Low cost. | Low |

| 2. Flexi Cap Fund | 30% | The Manager. Allows a pro fund manager to swing between large/mid caps based on market trends. | Moderate |

| 3. Mid Cap Fund | 20% | The Growth Engine. High growth potential companies of tomorrow. | High |

| 4. ELSS (Tax Saver) | 10% | The Tax Shield. Saves tax under 80C and provides lock-in discipline. | Moderate |

Why this works:

- Zero Overlap: The Index fund buys top 50 companies. The Midcap buys the next 150. The Flexi cap adjusts.

- Total Coverage: You own the whole economy.

- Low Stress: You only need to track 4 NAVs.

How to Fix Your Portfolio (Step-by-Step Guide)

If you are reading this and realizing you have 10+ funds, don’t panic. Do not sell everything tomorrow (you might incur Exit Loads and Capital Gains Tax). Follow this cleanup procedure.

Chart 5: The Cleanup Checklist

| Step | Action | Tool/Method |

| 1 | List All Funds | Write down every fund, its category, and current value. |

| 2 | Identify Duplicates | Do you have 2 Large Caps? 2 Tax Savers? Mark the underperformer in each pair. |

| 3 | Check Overlap | Use an “Overlap Tool” online. If overlap > 30%, one fund must go. |

| 4 | Stop SIPs | Immediately stop SIPs in the “Reject” funds. Do not sell yet, just stop buying. |

| 5 | Redirect Capital | Increase the SIP amount in your “Top 4” chosen funds. |

| 6 | Exit Strategically | Sell the bad funds only after they complete 1 year (to avoid Exit Load and Short Term Capital Gains Tax). |

Conclusion: Simplicity is the Ultimate Sophistication

Wealth creation is boring. It isn’t about finding the “next hot fund” every month. It is about asset allocation and patience.